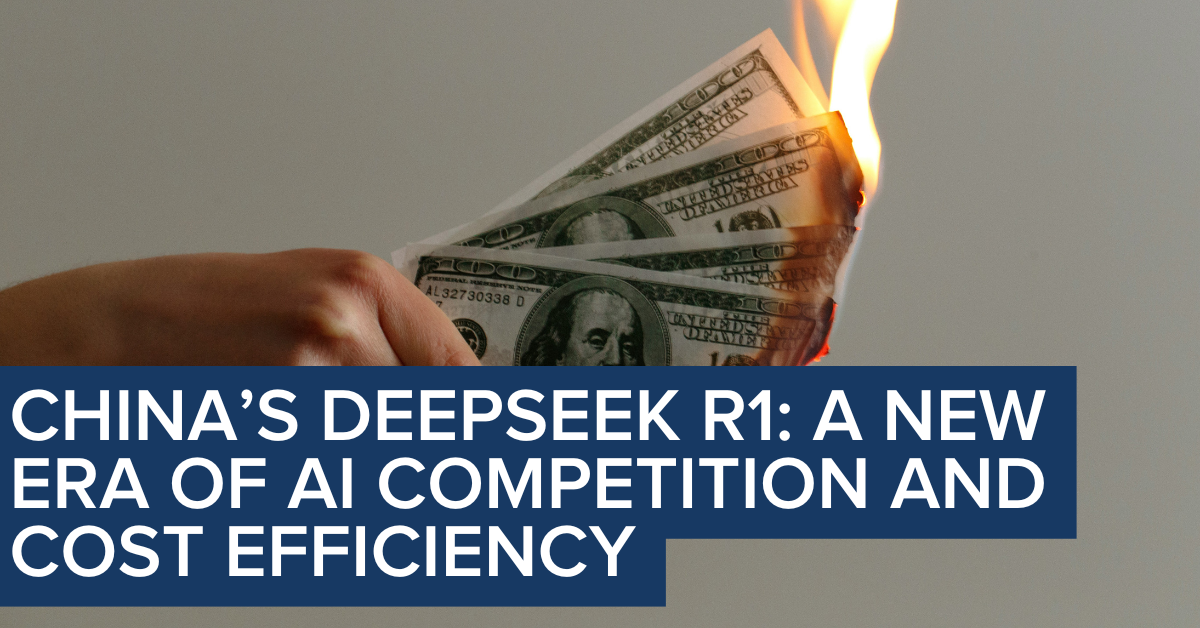

China’s DeepSeek R1: A New Era of AI Competition and Cost Efficiency

The AI world just got a lot more interesting.

DeepSeek, a Chinese AI research firm, has dropped a bombshell with its new model, R1.

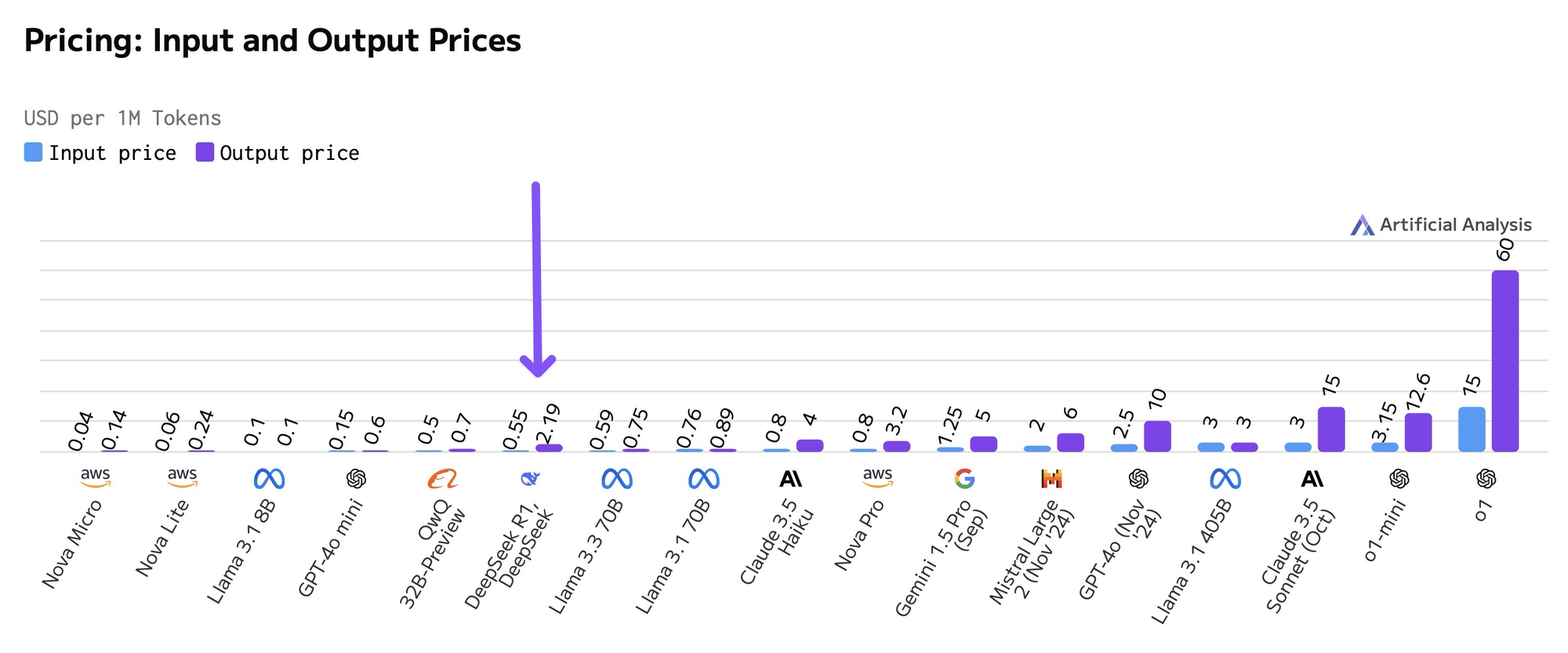

It’s faster, cheaper, and, in some cases, better than OpenAI’s top-tier (and most expensive) models.

DeepSeek R1: Key Takeaways

What’s special about this R1 model, and we’ll cover in more detail below, is that:

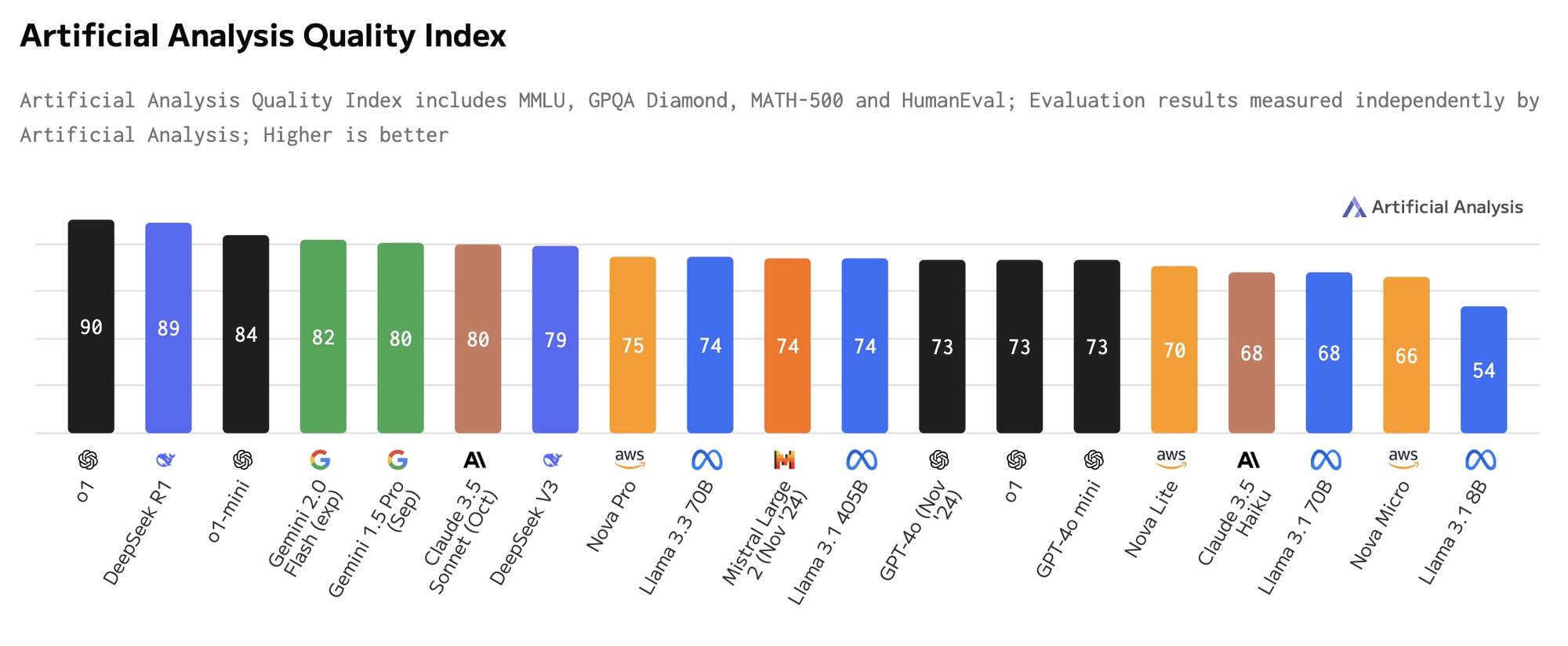

- At launch, DeepSeek R1 became one of the top-performing models

- R1 is open source

- R1 leveraged novel reinforcement learning techniques

- R1 outputs its chain of thought to help users get more insight into how the model “thinks,” unlike OpenAI’s o,1 which also thinks but does not share its chain of thought (CoT)

- R1 was produced on a relatively small budget (although not reflective of all costs) with limited access to state-of-the-art NVDA chips

So why does this all matter?

This isn’t just a technical win; it’s a wake-up call for the booming AI industry.

The U.S. has seemingly held a dominant position in AI for years, but DeepSeek’s rise signals a potential shift. This shift raises questions about AI supremacy for US companies. It also raises questions about open source vs. closed models (OpenAI, Anthropic, etc.).

The stakes are high, and the ripple effects have already shaken markets and are likely reshaping strategies at some of the largest technology companies in the world.

First, before we dive in, if you want to get to the meat of the technical details, check these resources:

- Official DeepSeek-R1 Paper

- A less technical deep dive into R1’s innovative approach to building an LLM

- Good article on DeepSeek’s innovations around Reinforcement Learning (RL)

DeepSeek R1: Doing More with Less

DeepSeek’s R1 model is open-source, outperforms OpenAI in specific tasks, and costs a fraction to run. The secret? Reinforcement learning (RL) a method that lets AI learn through trial and error. While U.S. giants pour billions into hardware and infrastructure, DeepSeek focused on smarter algorithms.

The result?

A model that took just ‘two months and $6 million to build’—without relying on Nvidia’s cutting-edge chips, which have export restrictions to China. Important note: there has been significant debate that DeepSeek’s parent company has a large stable of chips, including access to thousands of Nvidia chips, and spent significant resources to get to the point to make this model. Anthropic’s Founder added this:

“DeepSeek does not "do for $6M what cost US AI companies billions". I can only speak for Anthropic, but Claude 3.5 Sonnet is a mid-sized model that cost a few $10M's to train (I won't give an exact number).”

Regardless of the exact cost, DeepSeek was able to do more with less. And so, DeepSeek’s focus on getting the most out of their existing hardware and deploying novel learning strategies has proven to be a competitive advantage. For experts and casual users alike, the reception has been positive: DeepSeek knocked ChatGPT off the top spot on Apple’s App Store in multiple regions.

This isn’t just a win for DeepSeek; it’s proof that innovation can outpace resource limitations.

Markets in Turmoil: Rethinking AI Spending

DeepSeek’s success is forcing investors to ask hard questions. Companies like Google, Meta, and Amazon have spent hundreds of billions on AI infrastructure, betting big on high-end chips and massive data centers. But if DeepSeek can achieve similar results with far less, what does that mean for their ROI?

The uncertainty hit Nvidia hard, wiping $600 billion off its market cap in a single day—the biggest one-day loss in U.S. history. Yet, Nvidia praised DeepSeek’s R1 as an “excellent AI advancement,” while leaders like Microsoft’s Satya Nadella argued that lower costs will drive broader AI adoption.

A real question is whether this marks the end of the era of lavish AI spending—and what it means for venture capital firms that bet everything on expensive, proprietary models.

A Geopolitical Earthquake: China’s AI Ambitions

DeepSeek’s breakthrough isn’t just about technology; it’s about power.

Some pundits are calling it a “Sputnik Moment” for AI, drawing parallels to the Soviet Union’s 1957 satellite launch that shocked the U.S. into action.

For China, R1 is a statement: it can compete in AI despite U.S. sanctions and chip restrictions.

For the U.S., it’s a warning. The AI race is no longer a one-sided affair.

While DeepSeek’s achievements are impressive, they also highlight the challenges China faces in sustaining its progress without access to the latest hardware. Meanwhile, U.S. firms are under pressure to innovate faster and justify their massive investments.

What’s Next: Collaboration or Fragmentation?

The big question is where this leaves the global AI ecosystem.

Open-source models like R1 democratize access, empowering smaller players and startups. However, geopolitical tensions and export controls threaten to split the industry into competing blocs.

DeepSeek’s rise shows what’s possible when innovation meets necessity, but scaling these models sustainably—and ethically—remains a challenge.

For now, the AI landscape is in flux. The U.S. and China are locked in a high-stakes battle, and the winners will be those who can balance cutting-edge research with strategic resource allocation.

One thing’s clear: the rules of the game are changing, and no one can afford to stand still.

About UpMarket

UpMarket's mission is to unlock the private markets for individual investors.

We provide access to a range of asset classes and investment strategies that span private equity, hedge funds, crypto, real estate, and other alternative assets.

The problem

- A large barrier to entry due to high investment minimums

- Time-intensive because sourcing deals is a lot of work even if you’ve got a great network, and

- Costly because of investment-related diligence costs, paperwork, and legal fees

The solution

- Offering lower investment minimums

- Sourcing and conducting diligence on opportunities for investors, empowering them to pick and choose from pre-screened opportunities

- Making the investment process entirely digital, straightforward, and easy to manage from a single portal