Is Private Equity Eating the World (and your portfolio)?

Do you remember when Facebook went public? It was a huge deal. Facebook became the largest technology IPO in history at the time after raising $16 billion.

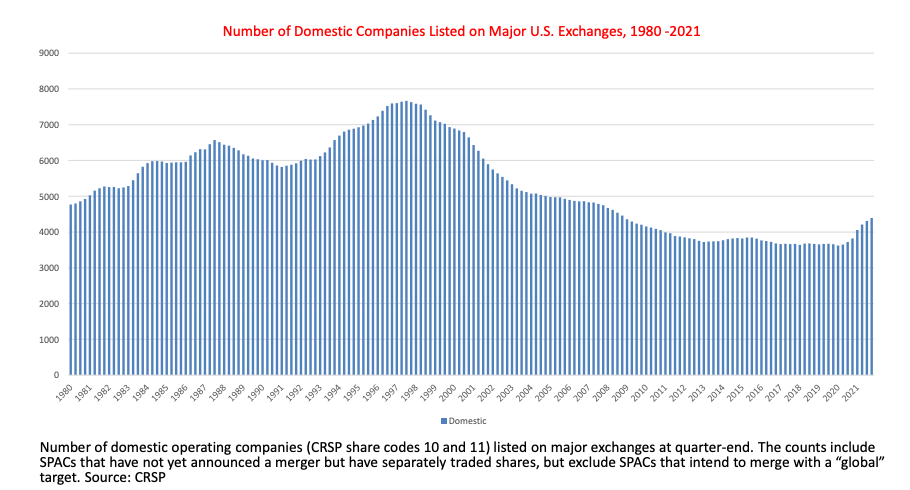

But these days, there's a new trend in the tech world: companies are staying private longer. In the past twenty years, the number of US-listed companies has gone down by more than 50%. So what is causing this change, and how does it affect investors like you?

In this post, we'll look at the rise of private companies, what it means for investors and the risks and benefits of investing in the private markets.

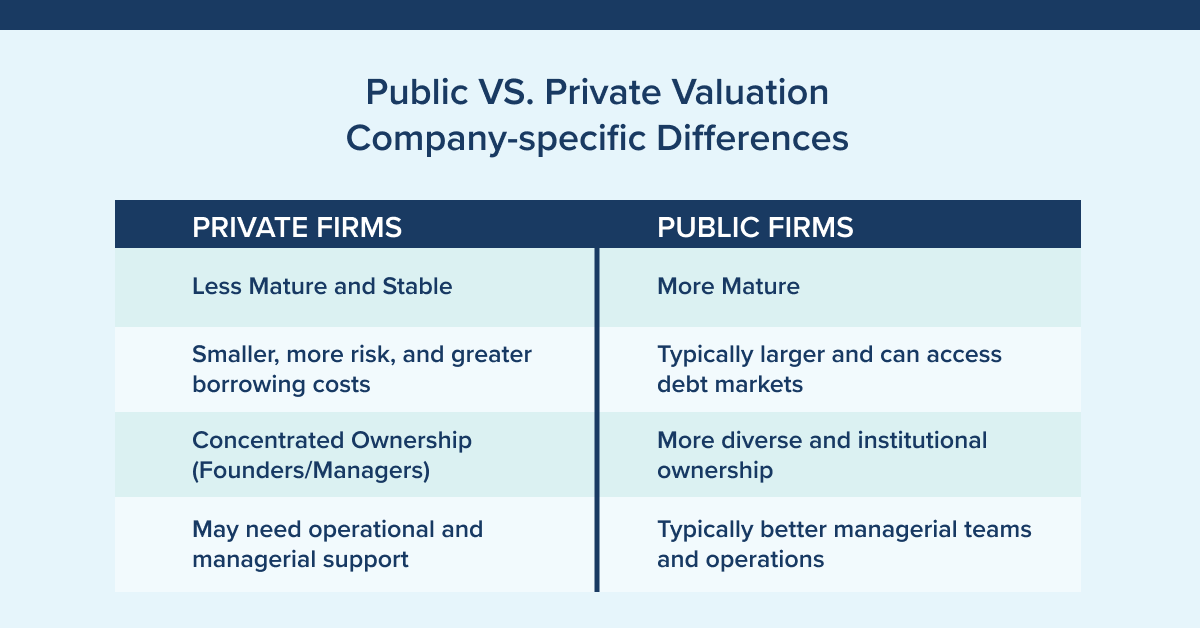

Private vs. Public Companies: The Difference

To understand the typical differences between private and public companies, let's start with a definition.

What is a public company?

A public company is a company whose shares are sold to the general public, typically through an initial public offering (IPO) or Special Purpose Acquisition Company (SPAC). Thereafter, the shares are available for trading on a stock exchange.

As a publicly-traded company, the company must follow specific regulations to increase transparency around its operations. The regulations include having to disclose financial information to the public on a regular basis.

The owners of public companies are the shareholders. The shareholders have a claim on the company's profits and losses but have a subordinate claim to debtholders on assets.

The definition of a private company

On the other hand, a private company is a corporation that has not gone through an IPO, SPAC or another method of public listing.

Private companies are typically owned by a small group of founders or investors, such as venture capital, private equity firms, or wealthy individuals and families. By definition, private companies' shares are not listed for trading on stock exchanges.

Companies may choose to stay private for several reasons. One reason is that they can avoid many of the costly regulations that publicly traded companies face.

For example, private companies are not bound by the Sarbanes-Oxley Act, a set of regulations that publicly traded companies must comply with to improve financial reporting transparency. This compliance can be costly, and private companies can avoid this expense by staying out of the public eye.

Another reason is that private companies have more control over how they share information, if at all.

When a company goes public, it must disclose a lot of information about its business, such as financials, general strategy, and even material changes in its customer base or product mix. This disclosure can give competitors an advantage. Private companies can avoid such disclosures by staying private.

The Upsides and Downsides

Both public and private firms have benefits and drawbacks. So, let's take a look at them.

Advantages of public companies

Below are some of the main advantages of going public.

Access to capital markets

Public companies can sell equity or debt in the public markets to raise funds. The funds are then used to grow and scale their businesses. Access to large amounts of capital can significantly add to the growth potential of a company, if well invested.

Improved liquidity

Trading, purchasing, and selling shares on the stock market can be easily done by the shareholders of public companies. This liquidity is not available to shareholders of private companies. Having liquid shares can attract more investors.

Enhanced credibility

Going public often enhances a company's credibility, as it shows that the business is successful and large enough to offer shares publicly and meet the various financial reporting and auditing requirements.

Disadvantages of public companies

Now, let's talk about the disadvantages.

Increased regulation

As mentioned earlier, public companies face increased regulations, which can be costly.

Loss of control

When a company goes public, its shareholders have a claim on the business, which means the founders and management may have less control. If management or the original founder does not control a majority of the voting shares they “lose control” of the company. Recently, we’ve seen some companies offer different classes of shares that have varied voting rights to retain control among founders or certain shareholders. Meta (formerly, Facebook) is a great example of this, as Zuckerberg controls nearly 90% of voting rights.

Disclosure of information

As a public company, you must disclose sensitive information about your business. This can give your competitors an advantage.

Advantages of private companies

Staying private also has its set of benefits, such as:

Avoidance of costly regulations

Private companies can avoid many of the costly regulations that public companies face.

More control over information

Private companies have more control over their information and don't have to disclose as much to the public.

Disadvantages of private companies

Meanwhile, below are some of the main reasons companies don’t want to stay private.

Limited access to capital markets

Private companies have limited access to capital, as they cannot sell equity in the public markets to raise capital.

Reduced liquidity

Private companies are less liquid than public companies, as their shares are not traded on the stock exchange market. So holders needing to raise capital may find it difficult to sell shares or be forced to share sells at a discount on short notice.

Lack of credibility

Private companies don’t have the same financial reporting and auditing requirements as publicly traded companies and some investors may be less inclined to invest in private companies because of this. Or the path to investment is much longer, as it may require additional due diligence before initiating an investment.

What’s Happened with IPOs Recently?

Initial Public Offerings (IPOs) have been declining materially since the early 1990s. While there has been a recent resurgence thanks to SPACs and speculative fervor in 2021, the trend still appears to be downwards. There have been various reasons behind this decline. However, one of the leading causes is the rise of private equity which keeps companies private.

Why fewer companies go public

Various factors are driving the trend of staying private.

Firstly, there's been a considerable influx of capital into the private markets. In 2017, global private equity fundraising hit a record high of $453 billion, over twice that of 2007.

And this growth is only expected to continue. According to McKinsey’s 2022 report, private equity was the “highest-performing private markets asset class” with assets under management (AUM) peaking at $6.3 trillion in 2021.

Thanks to this influx of capital, companies can now stay private for much longer and don't need to depend solely on the public markets to raise funds they can tap private debt and equity markets to fund their growth.

Lastly, there's been a change in attitude amongst entrepreneurs and investors. In the past, going public was seen as the ultimate goal for many founders.

But these days, many people view staying private as a more attractive option. For entrepreneurs, it allows them to retain control of their companies. For example, Stripe co-founder, John Collison, recently said “We’re very happy as a private company,” to indicate he had no immediate desire to take the large fintech company public.

The number of private companies has been on the rise in recent years. In fact, according to BlackRock's 2022 Private Markets Outlook, private equity tripled from $2 trillion to over $6 trillion in the past decade. And this trend seems to continue going.

One of the key drivers of this growth is the rise of private equity firms.

The Rise of the Private Equity Industry

Private equity is a type of investment that is typically only available to institutional, high-net-worth and accredited investors. Private equity firms invest in private companies often with the aim of improving operations and either holding the company, reselling it, or combining it with other private portfolio companies to lower costs and increase scale.

The private equity industry has grown in popularity as more and more companies have chosen to stay private. As mentioned earlier, in 2017, private equity firms raised a record $453 billion globally, or a 26% increase from the previous year.

The rise of private equity has had a number of impacts on the economy and the financial markets.

One impact is that small retail investors find it harder to gain access to a wide range of companies because many of them remain private for longer or never enter the public markets due to private equity acquisitions.

Another impact is that the rise of private equity, and increased investor capital in the private equity space, has driven up valuations for private companies as PE firms compete with each other to acquire assets.

A subject of some controversy, are the impacts of private equity on job creation because private equity firms have a history of acquiring companies then laying off employees in order to cut expenses. This can lead to short-term job losses. In the long-term, however, private equity can help create jobs by providing capital to growing businesses.

Overall, the growth of private equity has been a mixed bag for the economy and investors. On the one hand, it has made it harder for small investors to get access to investments into a wide range of companies. On the other hand, it has led to a secondary market that historically has created a lot of value for its investors.

How Much Has Private Equity Grown?

In the first quarter of 2019, a study by Bain & Company (see their chart above) showed that private equity firms were on track to raise $700 billion by 2020, which would be more than double the amount raised in 2007.

The projection turned out to be correct. Even in 2021, it continued growing and reached $1,228 billion.

What Does a Decreasing Number of Public Companies Mean for Investors?

There are several secondary effects of the decrease in the number of public corporations.

Firstly, it means that there are fewer investment opportunities available. With the public market shrinking, the options are limited for most investors.

Also, the rise in private equity makes it harder for retail investors to invest in early-stage companies. This is because these companies are often bought by private equity firms before they go public. So, if an investor doesn’t have access to private equity investments they may be missing a large piece of the market.

The Benefits of Investing in Private Equity

Investing in private equity can provide a number of benefits.

Higher returns

As a private investor, you can potentially gain higher returns. Buying businesses and selling them after guiding them through a period of rapid performance improvement is a regular process for PE firms. The success of private equity is largely attributed to this strategy, which combines business and investment portfolio management.

More opportunities

Private markets may open access to more investment opportunities because many companies chose to stay private for various reasons, including lower regulatory and reporting burdens.

Diversification

Investing in private equity can help diversify your portfolio. This is because the performance of private equity firms is not correlated with the stock market.

The Risks of Investing in Private Equity

Investing in private equity also comes with a number of risks.

Less liquidity

Private equity is illiquid. This means that you may have to wait a long time to sell your investment.

Higher risk

Private market assets can carry higher risk. This is because private equity firms may invest in early-stage companies, which are more likely to fail or they may make more aggressive use of debt financing or other strategies that can increase return potential and the risk of loss.

Lack of regulation

There are fewer rules governing how private equity firms must operate and report information to their shareholders. This lack of regulation and transparency can increase the level of risk for investors.

The Bottom Line

The growth of private equity is clear. The net effect has been a mixed bag for the economy and investors, with many private equity investors benefitting while those without access may feel left out. While 2021 was a banner year for SPACs and IPOs the longer-term trend is clear, fewer companies are going public and many are tapping the massive private markets and staying outside the reach of many investors.

Ultimately the fewer public companies listed on exchanges means less choice for investors in public equity markets. This means less ability to be able to participate in the financial upside of generational companies if they decide to remain private.

Some investors may seek to shift their portfolio allocations to private market opportunities including private equity.

Private equity can be a great way to earn high returns, but it can also come with a higher degree of risk. It's essential for individual investors to research their options carefully to successfully take advantage of the opportunities offered by private markets.

To learn more about investing in private market opportunities, including private equity funds, reach out to the UpMarket team. Our goal is to help individual investors benefit from the considerable potential of private markets.

Disclaimer: This article is only for knowledge sharing and does not constitute any investment advice. Anyone who makes an investment decision based on this article does so at their own risk. Any fund investment should be made through a formal confidential private placement memorandum and other fund documents. Potential investors should carefully read the risk factors in the private placement memorandum of securities issuance, and consult their own professional consultants if necessary, and receive advice on any investment, legal, tax or accounting issues. Past performance is not indicative of future performance, and the investment may potentially result in a loss of principal. The source and data of the material are considered to be reliable. However, there is no guarantee of its accuracy or completeness. The Company has no obligation to disclose or revise or modify this statement or any forward-looking statements as the circumstances change or as a result of subsequent events. Private equity funds are only suitable for specific qualified investors to subscribe. United States sales of the fund interests are exempt under Regulation D of the U.S. Securities Act of 1933, and are only applicable to potential investors who are eligible as "Qualified Investors" under Regulation D. Sales outside the United States are exempt under Regulation S of the U.S. Securities Act of 1933. Private equity funds are sold through Upmarket Securities LLC. Upmarket Securities LLC is a U.S. registered broker-dealer, and member of FINRA.

About UpMarket

UpMarket's mission is to unlock the private markets for individual investors.

We provide access to a range of asset classes and investment strategies that span private equity, hedge funds, crypto, real estate, and other alternative assets.

The problem

- A large barrier to entry due to high investment minimums

- Time-intensive because sourcing deals is a lot of work even if you’ve got a great network, and

- Costly because of investment-related diligence costs, paperwork, and legal fees

The solution

- Offering lower investment minimums

- Sourcing and conducting diligence on opportunities for investors, empowering them to pick and choose from pre-screened opportunities

- Making the investment process entirely digital, straightforward, and easy to manage from a single portal