Real Estate’s Potential Comeback: Why Hated Assets Deserve a Second Glance

When Nicolai Tangen, CEO of Norway’s $1.8 trillion sovereign wealth fund, stood at Davos on January 22nd and urged investors to “do the opposite of everybody else,” his words felt almost rebellious. Sell U.S. tech stocks? Buy unloved sectors like China? His contrarian call—to lean into “out of fashion” assets—arrived just days before markets wobbled, and Nvidia shed “almost $600 billion in market cap, biggest one-day loss in U.S. history,” proving once again that crowds aren’t always wise.

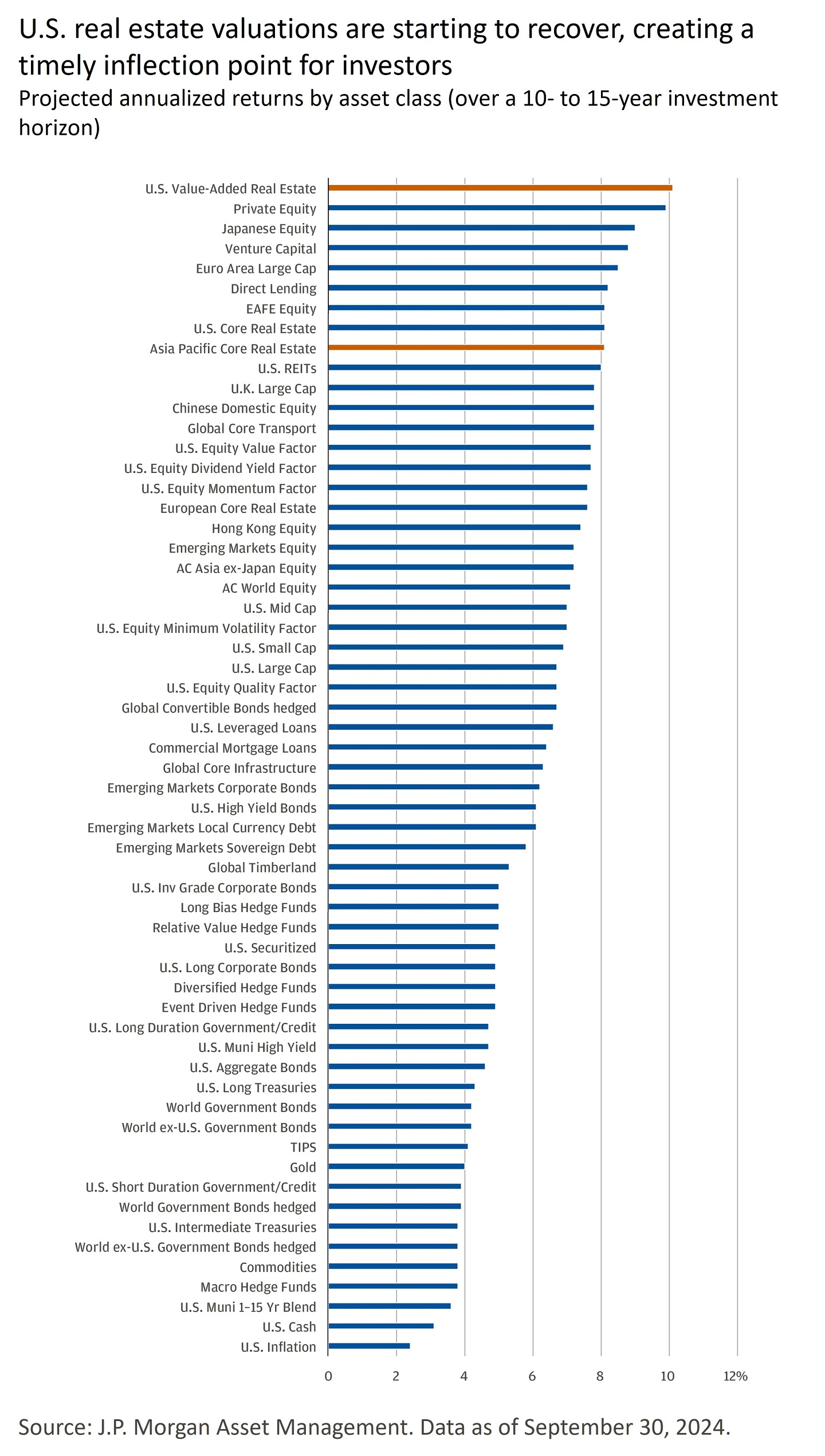

Today, real estate finds itself in that same “out of fashion” camp, battered by persistently high interest rates. But could this unpopular asset class be a quietly brewing opportunity?

The Rate-Driven Disillusionment

Real estate’s reputation has taken a hit. With borrowing costs at multi-decade highs, property valuations have softened, development pipelines have slowed, and investor enthusiasm has cooled.

For many, the math no longer works: higher mortgage rates dent affordability, while tighter financing squeezes returns. Publicly traded REITs (real estate investment trusts), often seen as a bellwether, have lagged behind equities in recent years. Yet, as Tangen’s advice hints, disdain can sometimes signal a turning point—especially when structural tailwinds emerge.

The Contrarian Case: A Housing Shortage That Won’t Quit

Enter J.P. Morgan’s 2025 Alternative Investment outlook, which spotlights a critical theme: the U.S. faces a persistent housing shortage. Decades of underbuilding, coupled with demographic shifts and rising household formation, have left America short millions of homes. This imbalance isn’t fleeting—it’s structural.

As JP Morgan Notes:

“The U.S. housing market made headlines in 2024 as ongoing shortages contributed to a supply-demand imbalance – so much so, the lack of affordable housing became a charged political issue.

Difficult as the situation is, the market dislocation is creating a structural opportunity for real estate investors globally. With an estimated shortage of 2 million to 3 million homes in the United States, the demand for housing far outstrips supply, and new real estate development is now a pressing social need. U.S. housing is more than just single-family homes, however: In addition to housing development, we are also focused on multifamily apartments, senior residential accommodation and workforce housing.”

Even as rates remain elevated, demand continues to outstrip supply, creating opportunities in residential development, multifamily housing, and even niche sectors like build-to-rent communities. “Shortages in the U.S. housing market create investment opportunities,” JPM notes, one that could buoy real estate broadly despite cyclical headwinds.

Beyond Bricks and Mortar: Income and Tax Perks

Real estate’s appeal isn’t just about price appreciation. In 2023, REITs alone paid investors an estimated $110.8 billion in dividends, underscoring the sector’s role as an income generator. Unlike stocks, real estate can also offer unique tax advantages: depreciation can offset taxable income, while tools like 1031 exchanges allow deferring capital gains taxes. For long-term investors, these features add layers of value often absent in other asset classes.

The Bigger Picture: Diversification in Disguise

J.P. Morgan’s alternative investment themes for 2025 extend beyond housing. They highlight an AI-driven energy bottleneck, a resurgence in private equity dealmaking, and rising capital investment—all of which intersect with real estate indirectly (think data centers, infrastructure, or industrial parks). Meanwhile, the “normalization” of interest rates, while still elevated, could stabilize financing markets over time, easing pressure on developers and lenders.

A Balanced View

None of this negates real estate’s risks. Higher-for-longer rates could prolong pain for overleveraged players, and certain sectors (like office space) face existential questions. But as Tangen’s contrarian stance reminds us, the most rewarding investments often emerge where others see only risk. The U.S. housing shortage, paired with real estate’s income potential and diversification benefits, suggests this unloved asset class may warrant a deeper look—not as a guaranteed win, but as a nuanced piece of a broader strategy.

Food For Thought: Should you Invest in what’s out of Favor?

Could today’s pessimism around real estate mirror past moments when hated sectors quietly pivoted to prosperity? As investors chase the next AI darling or tech unicorn, the numbers—and a growing body of institutional research—hint that sometimes, the best opportunities lie where the crowd isn’t looking. Whether real estate fits that bill remains to be seen. But in a world of echo chambers, a contrarian lens might just reveal hidden value.

What do you think? Is real estate’s unpopularity a red flag—or a roadmap?

About UpMarket

UpMarket's mission is to unlock the private markets for individual investors.

We provide access to a range of asset classes and investment strategies that span private equity, hedge funds, crypto, real estate, and other alternative assets.

The problem

- A large barrier to entry due to high investment minimums

- Time-intensive because sourcing deals is a lot of work even if you’ve got a great network, and

- Costly because of investment-related diligence costs, paperwork, and legal fees

The solution

- Offering lower investment minimums

- Sourcing and conducting diligence on opportunities for investors, empowering them to pick and choose from pre-screened opportunities

- Making the investment process entirely digital, straightforward, and easy to manage from a single portal