What is the Difference Between a Qualified Purchaser and an Accredited Investor

Summary & Key Takeaways

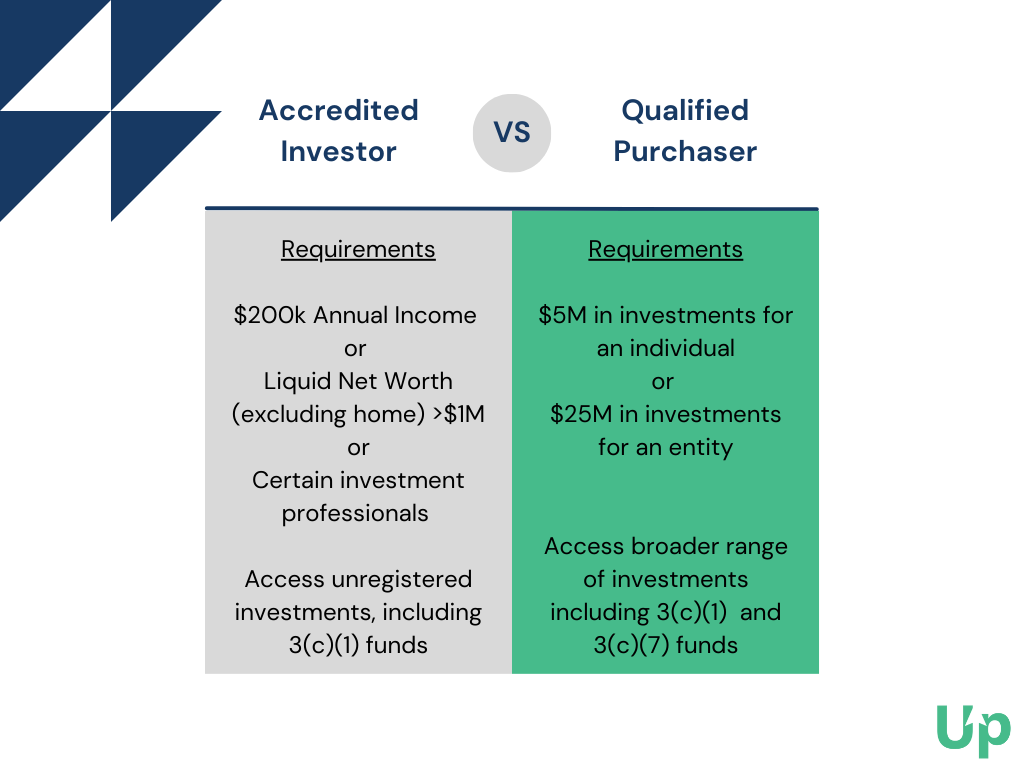

- Accredited Investor: This term generally refers to an investor that meets specific financial criteria set by the SEC, such as an annual income in excess of $200,000 or a net worth exceeding $1 million, excluding the primary residence. Accredited investors are allowed to invest in securities not registered with financial authorities.

- Qualified Purchaser: A qualified purchaser is a higher tier of investor who must own $5 million in investments as an individual or family-owned business, or over $25 million as an institution. These investors can participate in more exclusive and potentially risky investment opportunities.

- Differences and Implications: The primary differences between an accredited investor and a qualified purchaser lie in the financial thresholds and the breadth of investment opportunities available. Understanding these differences can help individual investors know what types of offerings they can invest in and their potential risks and rewards.

What is an Accredited Investor?

An accredited investor is an individual or entity that meets certain financial requirements set forth by the Securities and Exchange Commission (SEC). For an individual to be considered an accredited investor, they must have a net worth of at least $1 million, excluding the value of their primary residence, or an annual income of at least $200,000 (or $300,000 for joint income) for the past two years and a reasonable expectation of the same income in the current year.

Recently, the SEC broadened the accredited investor definition to include individuals who meet certain professional criteria, including:

- Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

- Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company)

- Any “family client” of a “family office” that qualifies as an accredited investor

- For investments in a private fund, “knowledgeable employees” of the fund

The purpose of the accredited investor designation is to ensure that those investing in private securities offerings have the financial means and/or investment knowledge to understand the risks involved in such investments. Accredited investors are able to invest in private securities such as hedge funds, private equity, and venture capital funds. Typically, these are called Regulation D Offerings, which fall under an exemption allowing firms to offer and sell securities without having to register the offering with the SEC. Accredited investors can access 3(c)(1) funds, which are pooled investment vehicles that are excluded from the definition of an investment company in the Investment Company Act because they have no more than 100 beneficial owners.

What is a Qualified Purchaser?

A qualified purchaser is also an individual or entity that meets certain financial requirements, but these requirements are more stringent than those for accredited investors. The term "qualified purchaser" is defined in Section 2(a)(51) of the Investment Company Act of 1940. To be considered a qualified purchaser, an individual must have at least $5 million in investments, while an entity must have at least $25 million in investments.

The purpose of the qualified purchaser designation is to identify investors that have a high level of investment sophistication and financial means to invest in certain types of private investment funds.

Qualified purchases can invest in 3(c)(1) funds, like accredited investors, but unlike accredited investors, they can also invest in 3(c)(7) funds. These 3(c)(7) funds are exempt from SEC registration requirements and can only be offered to qualified purchasers. The advantage of a 3(c)(7) fund is that the number of investors is not limited under the Act so a fund could take up to 1,999 investors before it is required to register with the SEC.

Main Differences Between Accredited Investors and Qualified Purchasers

| Criteria | Accredited Investor | Qualified Purchaser |

|---|---|---|

| Net Worth or Income | $1 million net worth (excluding primary residence) or $200,000 annual income ($300,000 if married) | Own at least $5 million in investable assets |

| Investment Opportunities | Access to private investment funds, such as hedge funds and private equity funds | Access to a broader range of investment vehicles, including certain private funds and pooled investment vehicles |

| Due Diligence Requirements | Adequate investment knowledge and experience | Less stringent due diligence requirements |

1. Financial Requirements

The primary difference between accredited investors and qualified purchasers is the financial requirement needed to qualify for each designation. As mentioned earlier, an accredited investor must meet a net worth or income requirement while a qualified purchaser must have existing investments in excess of $5 million.

2. Investment Opportunities

While both accredited investors and qualified purchasers can invest in private securities such as hedge funds, private equity, and venture capital funds, there are specific investment opportunities that are only available to qualified purchasers. For example, 3(c)(7) funds can only be offered to individuals or entities that meet the definition of a qualified purchaser.

3. Regulatory Protection

Both designations allow investment firms to offer securities to either qualified purchases or accredited investors without registration. This benefit "cuts both ways" in that it means the underlying offerings may have a greater risk of loss.

Conclusion

Understanding the difference between an accredited investor and a qualified purchaser is essential when considering which types of private securities one may invest in or offer as part of an investment strategy or fund structure. While both categories allow individuals or entities access to similar investment opportunities, the financial requirements and regulatory protections for each designation are significantly different.

In summary, accredited investors have lower financial requirements than qualified purchasers but they cannot invest in 3(c)(7) funds. On the other hand, qualified purchasers have higher financial requirements and can invest in any offering available to accredited investors, along with specific types of private investment funds that are not available to accredited investors.

Common Questions

What is the main difference between an accredited investor and a qualified purchaser?

The main difference lies in the financial thresholds. A qualified purchaser must own significantly more investments than an accredited investor.

Why should I care about these distinctions?

These distinctions matter because they determine what kinds of investment opportunities one can access. Greater access can mean more diversification and higher potential returns, but it also often comes with higher risk.

Can I become a qualified purchaser if I'm already an accredited investor?

Yes, you can, as long as you meet the higher financial thresholds required under the definition of a qualified purchaser.

What are the risks associated with being a qualified purchaser?

As a qualified purchaser, you may have access to more complex, potentially risky investment opportunities. It's important to fully understand these investments and assess your own risk tolerance before participating.

Disclaimer: The information contained in this article is not investment advice; and does not constitute a recommendation to buy or sell any securities. The information within this article is meant for informational purposes only. Any statement in this document does not mean that the firm nor its employees agrees, endorses or approves any content of the document. This article is only for knowledge sharing and does not constitute any investment advice. Anyone who makes an investment decision based on this article does so at their own risk. Any fund investment should be made through a formal confidential private placement memorandum and other fund documents. Potential investors should carefully read the risk factors in the private placement memorandum of securities issuance, and consult their own professional consultants if necessary, and receive advice on any investment, legal, tax or accounting issues. Past performance is not indicative of future performance, and the investment may potentially result in a loss of principal. The source and data of the material are considered to be reliable. However, there is no guarantee of its accuracy or completeness. The Company has no obligation to disclose or revise or modify this statement or any forward-looking statements as the circumstances change or as a result of subsequent events. Private equity funds are only suitable for specific qualified investors to subscribe. United States sales of the fund interests are exempt under Regulation D of the U.S. Securities Act of 1933, and are only applicable to potential investors who are eligible as "Qualified Investors" under Regulation D. Sales outside the United States are exempt under Regulation S of the U.S. Securities Act of 1933. Private equity funds are sold through Upmarket Securities LLC. Upmarket Securities LLC is a U.S. registered broker-dealer, and member of FINRA.

About UpMarket

UpMarket's mission is to unlock the private markets for individual investors.

We provide access to a range of asset classes and investment strategies that span private equity, hedge funds, crypto, real estate, and other alternative assets.

The problem

- A large barrier to entry due to high investment minimums

- Time-intensive because sourcing deals is a lot of work even if you’ve got a great network, and

- Costly because of investment-related diligence costs, paperwork, and legal fees

The solution

- Offering lower investment minimums

- Sourcing and conducting diligence on opportunities for investors, empowering them to pick and choose from pre-screened opportunities

- Making the investment process entirely digital, straightforward, and easy to manage from a single portal